|

Growth of Financial Services Sector

By:

Srivastava Saurabh

Mukherjee Ashim

Abstract: Services

are

economic activities- intangible such as banking, tourism,

insurance and accounting, in contrast to tangible goods.

The Indian Services sector is the most significant sector of

the Indian economy contributing nearly 55 per cent of the

GDP in 2006-07. The sector has come to play an increasingly

dominant role in the economy accounting for 68.6 per cent of

the overall average growth in GDP in the last five years

between 2002-03 and 2006-07.

Importance of the service industry has increased

dramatically over the last decade both at national levels as

well as global. De-regulation of services, growing

competition, increased demand and application of new

technology has posed a serious challenge to the service

providers. The importance of services as a source of

competitive advantage in manufacturing has increased greatly

in the last five years.

The most

happening field of financial service is banking where

the banks, private or public, are investing heavily to set

up infrastructure to incorporate Information Technology at

every single office process. Carrying bundles of notes for

shopping, standing in long queues for paying utility bills,

bringing home loads of groceries may soon turn history.

With the advent of Internet and Credit Cards, the above are

close to reality. Value based financial services have

become a new economic imperative. Banking system has

undergone tremendous transformation. From local to

regional; national to global, banking has seen it all.

Introduction

Industry

and services are two major pillars of Indian economy.

Together, they have fueled the economic growth in India.

Service industry in India comprising of - Information

Technology (IT), tourism, financial services, education,

media, health etc. has shown an impressive growth. The

Indian Services sector is one of the most significant

sectors of the Indian economy contributing nearly 55 per

cent of the GDP in 2006-07. The sector has come to play an

increasingly dominant role in the economy accounting for

68.6 per cent of the overall average growth in GDP in the

last five years between 2002-03 and 2006-07.

That means that service sector has overtaken the growth rate

of agriculture and manufacturing sector.

Zeithaml and Bitner say that Services are deed

process and performances. Gronroos in 1979

has attempted following definition of services: “service is

an activity or a series of activity of more or less

intangible nature that normally but not necessarily take

place in interaction between the customer and service

employees and or physical resources or goals and or systems

of the service provider which are provided as solutions to

the customer problems:” From the definition we can confer

that services involves activities arising out of interaction

between customer and the service provider. Services

includes all economic activities whose output is not a

physical product or construction.

Importance of the service sector has increased dramatically

over the last decade nationally as well as globally. The

de-regulation of services, growing competition, fluctuation

in demand and application of new technology has presented a

considerable challenge to the service companies.

Development of Service Industry

World

War II marked a milestone in the explosive rise of the

service industry. At the end of the war major social and

economic changes transformed western economies. The

restructuring of the shattered European economy brought

massive new investment projects, which placed new demands on

the financial service sector. Specialization in all areas of

production meant that business became more reliant upon

contracted services.

The

increased rate of spending upon personal consumption

services has also been impressive rising from approximately

30% to over 50% in the last 30 years.

Individuals are spending great proportion of their income on

travel, restaurant and leisure services to improve the

quality of their lives; on telephone postal and

communication services reflecting a more dynamic and fast

moving environment and on purchasing better quality health

and educational services. The growing complexity of

banking, insurance, investment, accountancy and legal

services has led to greater demands for financial and

professional services in each of these areas.

Over the

past few decades service sector has come to dominate our

economy. The trend has been so strong that it has been

described as second industrial revolution.

This sequence of events indicates the transformation of

services as a full-fledged industry as an aftermath of World

War II. The importance of services as a source of

competitive advantage in manufacturing has increased greatly

in the last five years. This is reflected in the 68.6

percent of overall average growth in gross domestic product

(GDP) between the years 2002 – 03 and 2006 – 07.

The

year 2004 marked a turning point in the history of global

trade in services, with growing acceptance of IT based

global delivery model. With ever increasing availability of

international bandwidth and powerful workflow management

software, it is now possible to disaggregate any business

process, execute the sub-processes in multiple centers

around the world, and reassemble it, in near-real time, at

another location. This is driving fundamental changes in the

global IT services landscape, vendors and customers are

redefining the levels of value creation in the industry. In

the wake of changing global service landscape, Indian

Information Technology (IT) and IT enabled services (ITeS-BPO)

continue to chart remarkable growth.

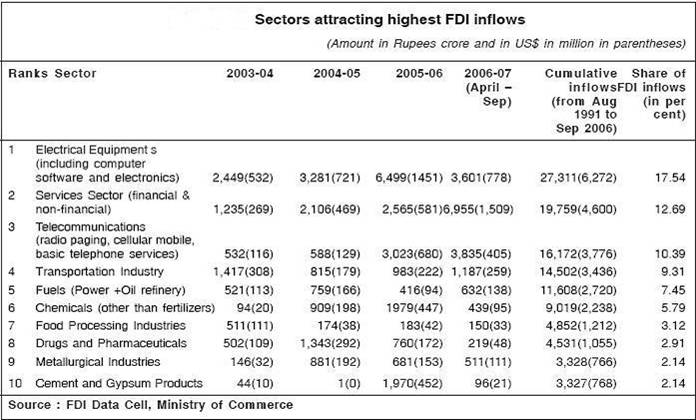

This growth has encouraged FDI into services sector. The

chart below shows that service sector is the second most

preferred sector for FDI, topping telecommunications and

transportations.

Financial sector

Indian

economy grew at the rate of 9.4 per cent in 2006-07 which

was 9 per cent in 2005-06. Of this, services grew at an

impressive rate of 11 per cent in 2006-07 against 9.8 per

cent in 2005-06.

That means services sector continued to record double-digit

growth in the current fiscal with a growth rate of 10.6 per

cent during the first quarter of the current fiscal year.

The major growth has been witnessed in the following areas:

·

Trade, hotels, transport and communication grew by a robust

growth rate of 12 per cent.

·

Financial services (comprising banking, insurance, real

estate and business services) grew by 11per cent as against

10.8 per cent.

·

Community, social and personal services grew at the rate of

7.6 per cent.

A rapid transformation

has been taking place in the financial sector. According to

Ministry Of Finance it is expected that the finance industry

in India is worth US$ 28 billion and it has grown at around

15 per cent per year.

The key to success has been adaptability to the

environment. The need and demand for financial products and

services have increased. The industry responded by being

innovative and finding lucrative segments. Banks capital

markets and insurance companies have come up with wide range

of products and services. Add to this, RBI measures to keep

the interest rates affordable.

Banking

The

Indian banking system has a large geographic and functional

coverage. Presently the total asset size of the Indian

banking sector is US$ 270 billion while the total deposits

amount to US$ 220 billion with a branch network exceeding

66,000 branches across the country. Revenues of the banking

sector have grown at 6 per cent CAGR over the past few years

to reach a size of US$ 15 billion.

Banking

has witnessed exciting growth avenues. Mr. M.V. Nair has

identified four factors

propelling the growth. They are: Globalization,

liberalization, customers and technology.

Globalization and liberalization have together opened up new

markets and segments. Indian market witnessed coming up of

foreign banks. A new marketing approach and culture has

been infused into Indian banking system. This system

focuses more upon providing lifelong better customer

satisfaction and value added services. Apart from that

organizations are moving more towards untapped potential.

So the focus has shifted from urban to rural segment. As a

result there has been an altogether very different strategic

approach for this ‘very special market’. Banking has also

been largely affected by IT. In fact, banks were wise

enough to understand the implications of IT in banking

operations. As a result, they have been early adopters of

IT and related technology. This has made it more customer

friendly. The disposal of information and services is quick

and fast.

Insurance

Insurance industry till now was a dominance of Indian

companies. With globalization and IRDAs liberal policies,

Indian market was opened up for foreign investment with the

conditions that they can enter insurance market in

collaboration with an Indian company only. As a result now

there are 15 private players in Life insurance against 1

public sector organization which is LIC. Whereas in Non Life

insurance there 6 public players against 9 private players.

Life

insurers:

The life

insurers underwrote a premium of Rs. 29664.64 crore during

the six months in the current financial year as against Rs.

11323.13 crore in the comparable period of last year

recording a growth of 161.98 per cent. Of the total premium

underwritten, LIC accounted for Rs. 23435.08 crore and the

private insurers for Rs. 6229.56 crore. The premium

underwritten by the LIC and the new insurers grew by 178.69

per cent and 113.78 per cent respectively, over the

corresponding period in the previous year.

Non life

insurers:

Non-life

insurers underwrote a premium of Rs. 12377.76 crore during

the first half of the current financial year recording a

growth of 22.81 per cent over Rs.10079.15 crore underwritten

in the same period of last year. The private sector non-life

insurers underwrote a premium Rs. 4340.57 crore as against

Rs. 2688.50 crore in the corresponding period of the

previous year, recording a growth of 61.45 per cent. Public

sector non-life insurers underwrote a premium of Rs. 8037.19

crore which was higher by 8.75 per cent (Rs. 7390.65 crore

in the first half of 2004-05).

Regulation and development of financial markets,

institutions, technology etc.

To

enhance efficiency and stability of the financial system and

thus contribute to growth and employment, RBI has taken

several steps

for widening, deepening and integrating financial

markets.

-

New processes and

institutional arrangements have been put in place in

regard to the banking sector, deposit-taking non-banking

financial companies and systemically important

non-deposit-taking non-banking financial companies.

-

These initiatives, in

particular supervisory systems, are in alignment with

the global best practices, but there are dynamic trade

offs between public ownership of financial institutions,

regulation, financial innovation, etc.

-

Several steps have

been taken to enhance use of technology and market

micro-structures in the financial sector. The financial

sector policies are continuously evolving, essentially

in a proactive manner.

-

Medium term

frameworks or vision documents have been formulated in

each of these areas since 2004 and are being implemented

through a continuous process of consultations with

market participants and industry associations.

Conclusion

Financial sector needs to be ready to take on the challenges

unleashed by various external forces such as competition

globalization , shrinking margins and internal forces

relating to human resources, needs for changes procedures

etc. Government has followed a liberal policy. Because of

these policies, our economy is said to be growing at a good

pace.

Substantial portion of

these problems can be easily addressed by technology.

Financial sector in India need to be complimented in the

inculcation of technology in large way in their day to day

operations. Credit must be given to Indian banks that have

brought on the new wave of techno banking in the country.

In a short span of less than 2 decades, customers of bank

have felt the positive impact of technological solutions

implemented by the bank.

As Shri V. Leeladhar

Deputy Governor RBI remarks – “Technology has today become

basic necessity rather than luxury in the banking sector”.

Reasons why banking sector is feeling the need of technology

are importantly:

-

Lower cost of

accounting services

-

Better customer

relation and

-

Because they have to

|