October - December 2006 Vol 2 Issue 11

1. Introduction

1.1 The Indian IT Industry

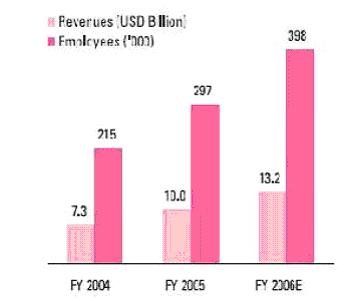

When the World Bank-funded report in 1992 identified India as a possible software superpower, it appeared a distant and fancy dream. With software export revenues of a little over $100 million, India had neither a clutch of `high profile' software companies nor the `visibility' to make a difference at the global level.

It has since grown to a staggering USD 13.5 Billion in 2005. No other Indian industry has performed so well against the global competition. Yet, with these numbers, the entire industry is just over half the size of IBM.

Fig 1 – Indian IT services exports : Growth Trends Source: NASSCOM

India’s advantage has stemmed for the following reasons:

1. English Language proficiency

2. Government Support and policies

3. Cost advantage

4. Strong tertiary education

5. Process quality focus

6. Skilled workforce

7. Expertise in new technologies

8. Entrepreneurship

9. Reasonable technical innovations

10. Existing long term relationships

11. Creation of global brands

12. BPO & Call center offerings

13. Expansion of existing relationships

14. Indian domestic-market growth

15. Urban Infrastructure

1.2 Industry Delivery Model Evolution

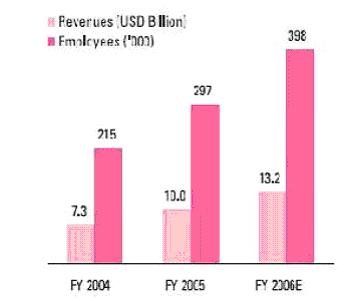

Until 1994, nearly 70-75 per cent of the Indian software exports were executed in the form of onsite services (body-shopping) at the client site, say, in the US or Europe.

In the early 1990s, starting with low-end basic maintenance and migration projects involving code-writing for blue-chip multinationals, TCS, Infosys and Wipro pioneered the Global Delivery Model (GDM). The global delivery model till the early 2000s meant delivering work out of India for client locations. The model is now evolving to include other low cost locations across the world

2. Why should Indian firms go Global?

There are inherent dangers involved in betting on a single labor market or single geography. These risks include wage inflation, currency appreciation, legislative change, political instability and natural disasters.

2.1 Skill Shortage and Wage Increases

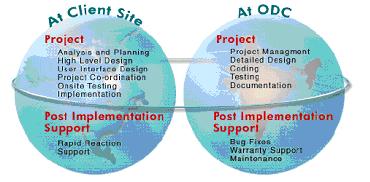

According to a NASSCOM Mckinsey report in 2005, the IT industry is expected to reach revenues of USD 60 Billion by 2010 growing at over 25% a year. But the greatest challenge staring the software services exports in the face is skill shortage - a shortage of 150,000 employees by 2010. Simultaneously, the wages for IT workers is increasing steadily.

Expectations of global sourcing providers are increasing with a shift from staff augmentation services to full sourcing and an increasing requirement of improved service levels. This puts an even greater emphasis on having a high skilled workforce.

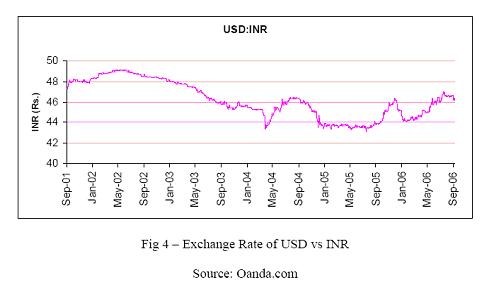

2.2 Currency Appreciation

The local labor rates are rising, and the India Rupee in the long term will appreciate against a weakening U.S. dollar.

2.3 Capturing Mega Deals

While Indian IT executives talk about moving up the value chain, their firms are unlikely to capture large projects—more than $100 million—or mega contracts—more than $1 billion—without an extensive onshore presence.

Additionally, as the marketplace becomes more global, there is a growing need for 24x7 support with local language skills. This support model stresses any organization operating in a single geography, as night shift work is less appealing to local employees. Given the growth of talent pools around the world, greater consideration must be given to expanding to other locations to provide this 24x7 support more seamlessly.

2.4 Other Factors

Geo-political instability, natural disasters, changes in tax laws and terrorism can leave an unhedged organization in a precarious situation should these risks be realized. Having a geographically dispersed workforce capability will provide built-in redundancy and management levers to organizations faced with risks being realized.

3. Strategies for going Global

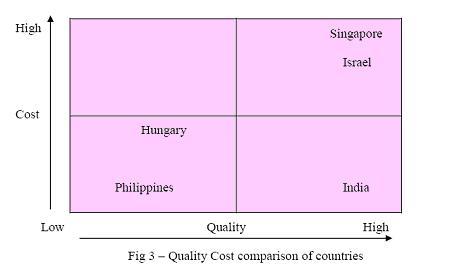

Indian IT organizations should create a virtual network of low-cost IT delivery centers around the world, tapping the individual strengths of these locations while mitigating the risks describer earlier.

3.1 Expanding to other countries

Following are commonly targeted geographies and their relevant market traits: 1. Philippines: Represents a fast-growing market for its U.S.- oriented culture and English language skills.

2. China: Is attractive from a cost perspective and will be more of a factor in the near future. The acquisition of English language skills will be critical to the market’s growth.

3. Russia: Has become attractive to European companies due to its time zone and cost advantages. However, a lack of English language skills and questions over economic and political stability make Russia a tough market to leverage.

4. Latin America: Has become attractive for its time zone and cost advantages. However, currency volatility makes longterm return on unhedged investments less predictable.

5. Eastern Europe: Has become especially attractive to European companies due to its language, time zone and cultural similarities.

6. Canada: Has become especially attractive to U.S. companies due to its language, time zone and cultural similarities.

However, competing with the economics of other lower cost locations may become tougher for Eastern Europe and Canada.

Indian firms have invested close to $50 million in China and employ nearly 2,000 people there, says NASSCOM. According to Forrester Research, Infosys Technologies proposes to spend $100 million in the next one year to hire and train 25,000 persons globally, including from Massachusetts Institute of Technology and Harvard University.

This section briefly discusses important measures which must be taken by Indian IT vendors while opening up their global centers.

4.2.1 Knowledge Sharing

The following kinds of knowledge are important: domain (for example, tax- and salary rules); methodologies used (about developing estimates for example); and the products and tools (bug tracking tools and programming languages for example). The problems of knowledge sharing could be addressed through the

1. Increased onsite presence

2. Closer control over movement of personnel

3. Cultural training

4.2.2 Project Management and Communication

Two key project-management related problems arise in GDM - role and movement of key people and project reporting. Indian vendors must transfer their strong project management skills in managing projects to the people in their offices abroad.

3.3 Acquisitions

Acquisitions should be a careful process and following guidelines should be followed for any potential acquisition:

1 Be operating in a niche area

2 Have a high post-sale implementation and customization component

3 Have an established base of customers with high retention potential

4 Create synergy with existing services and have the potential to apply the offshore development model

Recent acquisitions include that of Expert Systems in Australia by Infosys and US firm NerveWire by Wipro.

3.4 Alliances

Indian firms must work with alliance partners with best in class technologies to develop solutions. These alliances could be in terms of Marketing (jointly developing, selling and delivering business solutions) or Technology (build business and technical competency). Forming proactive partnerships with universities in both curriculum development and basic and applied research could benefit Indian IT firms.

3.5 Building Brand Equity

To compete with global giants like IBM and Accenture, Indian software firms will have to invest heavily in building their own brand equity. They must position themselves not as low cost provider of services but capable of delivering high value-add services which are customizable. This equity must be built keeping not just customers but also employees and investors in mind.

3.6 Building a Wide Customer Base

Currently, about 70% of the India’s software revenues come from USA. It is recommended that firms build a sizeable base in Europe and APAC too as it will help firms minimize the correlation between the firm’s growth and the economic conditions in US. In addition, there should not be too much dependency on a particular client or a particular vertical. This way, the business cycles in a particular vertical will least impact the firm’s growth.

3.7 Expand Portfolio of Services

Most Indian IT firms today operate at the middle or lower end of the value chain. There must be an effort to move up the value chain to garner higher margin business and to also tap on to its trickle effect.

3.8 Acquire Domain Knowledge

It is recommended that firms should hire resources that are experienced not only in various technologies but also in certain verticals. The firms should also ensure that adequate training and exposure is provided to the employees to acquire domain expertise.

4. Indian IT Firms – Strengths and Limitations in Global Expansion

4.1 Strengths

4.1.1 Processes

Most Indian firms have standard processes (say, Capability Maturity model) ingrained in the organization right from hiring, training to delivery and maintenance. These processes ensure that the quality is maintained while businesses scale up.

4.1.2 Management

Indian management has been excellent in project and process management. The Major software players have an excellent record in delivering services within time and within budget.

4.1.3 Early movers into Low cost GDM

Indians have been the pioneers of the low cost GDM. The global giants, having recently entered this space would take another 2-3 years to fully understand and deliver low cost services (and understand the cultural issues). This should provide enough lead time to Indian firms to build scale abroad.

4.2 Limitations

4.2.1 Limited Financial Strength

The IBMs and Accentures can easily carry out big acquisitions and expand their global presence much faster than their Indian counterparts.

4.2.2 Knowledge Leadership

In association with IT services, knowledge leadership spans three somewhat overlapping categories: technology innovations, concept development, and process leadership. Indian IT firms have established a high standard in software development, but not in innovating next-generation tools, languages, technology concepts, and standards.

Although they will encounter both internal challenges and external constraints during the process, Indian firms must acquire these knowledge leadership capabilities if they are to compete successfully for large and mega projects.

5. Challenges for Managing a Global Organization

5.1 Primary Research Results

We asked a set of IT managers on what they felt were the biggest challenges in managing a global organization. The results are shown below:

5.2 Preventing Over-Diversification

As an organization expands to other locations, there will come a point where the benefits of diversification may begin to diminish. The complexity of trying to manage too many different locations may otherwise start to cancel out any risk mitigation benefits for ensuring a more predictable return.

5.3 Achieving seamless integration

As an organization achieves a diversified portfolio of workforce sourcing options, its management will be challenged with uniting the independent workforce locations as a single, cohesive unit. This requires providing a commonality of infrastructure, process, vocabulary and culture.

5.4 Common operating model

To help achieve seamless integration, individual work streams and lifecycles must be managed end-to-end by a global network governed with a single operating model. Aligning by skills rather than applications enables improved workload balancing of employees as well as increased reuse of technology assets and application patterns.

5.5 Business requirements management

Firms should focus on achieving business objectives and results versus just contractual compliance. To help achieve objectives, tight linkage to the business requirements is essential. Otherwise, small ripples of misunderstandings can easily become tidal waves by the time they reach global sites. The introduction of multiple remote sites will only amplify such misunderstandings, translating into missed business objectives

5.6 Governance

Governance is the critical component (formal and informal processes and rules for managing the relationships between organizational entities) for ensuring an organization’s operating methods are consistently applied across a multi-site delivery network.

5.7 Managing Diverse Cultures

Moving beyond geographical boundaries to build a global delivery model will see organizations building their people assets from a multiplicity of backgrounds, cultures, regions and religions. Also prevalent will be teams composed of employees from different regions of the world. A focused efforts towards maintaining the work ethos and acceptance of diverse perspectives can effectively lay the foundation for employees to feel comfortable in any and every work setting where they would treat fellow colleagues with due respect and appreciation.

5.8 Managing Cost Structures

As Indian firms expand abroad (both in developed and developing nations) and global firms in India, their cost structures will converge. Given this inevitable outcome, Indian firms must rapidly build scale to prevent being wiped out.

5.9 Managing Growth

Indian firms need to seek culture-specific talents such as familiarity with work culture, laws, social norms, and government bureaucracy. Most Indian IT firms will continue to face significant challenges in retaining talent in an expanding market with increased competition from global competitors.

The focus in this regard should always be on building a strong foundation of people and systems early on which can provide the support for not only managing but also sustaining a fast pace of growth. Even during growth phases, the business objectives, which are to serve customers efficiently and effectively should not be put aside in the hope of delivering them greater value post the formation of an even larger organization.

5.10 Innovation

Management must alter incentives and organizational processes to foster innovative thinking. Indian firms must challenge established practices and support their workers in pursuing unconventional thinking.

6. Tapping Foreign Capital

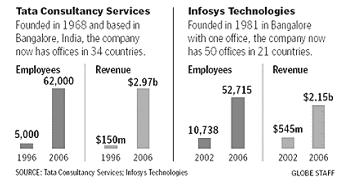

The route that Indian software giants have followed is first building on the financial strength of their local investors and seeking employees’ contribution for growth & expansion. These companies have then moved towards listing their shares on NASDAQ and other exchanges in the form of ADRs / GDRs. To be able to find a strong foothold in foreign markets, or even among foreign investors in India, it is very essential to reach a certain scale of operations.

Firms like Infosys and TCS, because of their partnerships with many of the Fortune 500 companies, held them in good stead in terms of reputation and professionalism. And it was the confidence of these Fortune 500 firms that led to investor confidence from outside India in these firms. Recently, The Government of India has also started actively providing fiscal incentives and liberalizing norms for FDI and raising capital abroad.

Private Equity is another source of funding for expansion. Until 1999, the venture creation phenomenon for the IT sector in India had been quite unsatisfactory. However, post 2000, things have been changing dramatically for the better. Venture capital has been the main source of finance for software industry in India, and even around the world, in the small and medium enterprise sector. Companies that have benefited the most from VC funding are Rediff, Mastek and many others. Post the dot com bust, norms for the operations of venture capital funds have also been liberalized to boost the industry.

7. Conclusion

MNC companies will have to learn the ropes, make investments and make the required changes in sales, delivery and marketing in order to deliver lower cost services. For this, they will need at least 2 to 3 years. This time must be utilized by Indian firms to establish their low cost centers abroad as well as their presence near the clients.

In conclusion, the Indian software industry is undergoing a decisive phase in its evolution today, and it would be a wise step for the industry to take lessons from the Big Five. The challenges and strategies presented in the paper are generic and individual firms will need to perform a deeper analysis into how they can win this game at the global level – where it is bound to reach in the very near future.

Brainwave

Taking Indian IT Conglomerates Global

Rahul Budhwar

Faculty of Management Studies

Megha Goyal

Indian Institute of Foreign Trade

1. Introduction

1.1 The Indian IT Industry

When the World Bank-funded report in 1992 identified India as a possible software superpower, it appeared a distant and fancy dream. With software export revenues of a little over $100 million, India had neither a clutch of `high profile' software companies nor the `visibility' to make a difference at the global level.

It has since grown to a staggering USD 13.5 Billion in 2005. No other Indian industry has performed so well against the global competition. Yet, with these numbers, the entire industry is just over half the size of IBM.

Fig 1 – Indian IT services exports : Growth Trends Source: NASSCOM

India’s advantage has stemmed for the following reasons:

1. English Language proficiency

2. Government Support and policies

3. Cost advantage

4. Strong tertiary education

5. Process quality focus

6. Skilled workforce

7. Expertise in new technologies

8. Entrepreneurship

9. Reasonable technical innovations

10. Existing long term relationships

11. Creation of global brands

12. BPO & Call center offerings

13. Expansion of existing relationships

14. Indian domestic-market growth

15. Urban Infrastructure

1.2 Industry Delivery Model Evolution

Until 1994, nearly 70-75 per cent of the Indian software exports were executed in the form of onsite services (body-shopping) at the client site, say, in the US or Europe.

In the early 1990s, starting with low-end basic maintenance and migration projects involving code-writing for blue-chip multinationals, TCS, Infosys and Wipro pioneered the Global Delivery Model (GDM). The global delivery model till the early 2000s meant delivering work out of India for client locations. The model is now evolving to include other low cost locations across the world

2. Why should Indian firms go Global?

There are inherent dangers involved in betting on a single labor market or single geography. These risks include wage inflation, currency appreciation, legislative change, political instability and natural disasters.

2.1 Skill Shortage and Wage Increases

According to a NASSCOM Mckinsey report in 2005, the IT industry is expected to reach revenues of USD 60 Billion by 2010 growing at over 25% a year. But the greatest challenge staring the software services exports in the face is skill shortage - a shortage of 150,000 employees by 2010. Simultaneously, the wages for IT workers is increasing steadily.

Expectations of global sourcing providers are increasing with a shift from staff augmentation services to full sourcing and an increasing requirement of improved service levels. This puts an even greater emphasis on having a high skilled workforce.

2.2 Currency Appreciation

The local labor rates are rising, and the India Rupee in the long term will appreciate against a weakening U.S. dollar.

2.3 Capturing Mega Deals

While Indian IT executives talk about moving up the value chain, their firms are unlikely to capture large projects—more than $100 million—or mega contracts—more than $1 billion—without an extensive onshore presence.

Additionally, as the marketplace becomes more global, there is a growing need for 24x7 support with local language skills. This support model stresses any organization operating in a single geography, as night shift work is less appealing to local employees. Given the growth of talent pools around the world, greater consideration must be given to expanding to other locations to provide this 24x7 support more seamlessly.

2.4 Other Factors

Geo-political instability, natural disasters, changes in tax laws and terrorism can leave an unhedged organization in a precarious situation should these risks be realized. Having a geographically dispersed workforce capability will provide built-in redundancy and management levers to organizations faced with risks being realized.

3. Strategies for going Global

Indian IT organizations should create a virtual network of low-cost IT delivery centers around the world, tapping the individual strengths of these locations while mitigating the risks describer earlier.

3.1 Expanding to other countries

Following are commonly targeted geographies and their relevant market traits: 1. Philippines: Represents a fast-growing market for its U.S.- oriented culture and English language skills.

2. China: Is attractive from a cost perspective and will be more of a factor in the near future. The acquisition of English language skills will be critical to the market’s growth.

3. Russia: Has become attractive to European companies due to its time zone and cost advantages. However, a lack of English language skills and questions over economic and political stability make Russia a tough market to leverage.

4. Latin America: Has become attractive for its time zone and cost advantages. However, currency volatility makes longterm return on unhedged investments less predictable.

5. Eastern Europe: Has become especially attractive to European companies due to its language, time zone and cultural similarities.

6. Canada: Has become especially attractive to U.S. companies due to its language, time zone and cultural similarities.

However, competing with the economics of other lower cost locations may become tougher for Eastern Europe and Canada.

Indian firms have invested close to $50 million in China and employ nearly 2,000 people there, says NASSCOM. According to Forrester Research, Infosys Technologies proposes to spend $100 million in the next one year to hire and train 25,000 persons globally, including from Massachusetts Institute of Technology and Harvard University.

This section briefly discusses important measures which must be taken by Indian IT vendors while opening up their global centers.

4.2.1 Knowledge Sharing

The following kinds of knowledge are important: domain (for example, tax- and salary rules); methodologies used (about developing estimates for example); and the products and tools (bug tracking tools and programming languages for example). The problems of knowledge sharing could be addressed through the

1. Increased onsite presence

2. Closer control over movement of personnel

3. Cultural training

4.2.2 Project Management and Communication

Two key project-management related problems arise in GDM - role and movement of key people and project reporting. Indian vendors must transfer their strong project management skills in managing projects to the people in their offices abroad.

3.3 Acquisitions

Acquisitions should be a careful process and following guidelines should be followed for any potential acquisition:

1 Be operating in a niche area

2 Have a high post-sale implementation and customization component

3 Have an established base of customers with high retention potential

4 Create synergy with existing services and have the potential to apply the offshore development model

Recent acquisitions include that of Expert Systems in Australia by Infosys and US firm NerveWire by Wipro.

3.4 Alliances

Indian firms must work with alliance partners with best in class technologies to develop solutions. These alliances could be in terms of Marketing (jointly developing, selling and delivering business solutions) or Technology (build business and technical competency). Forming proactive partnerships with universities in both curriculum development and basic and applied research could benefit Indian IT firms.

3.5 Building Brand Equity

To compete with global giants like IBM and Accenture, Indian software firms will have to invest heavily in building their own brand equity. They must position themselves not as low cost provider of services but capable of delivering high value-add services which are customizable. This equity must be built keeping not just customers but also employees and investors in mind.

3.6 Building a Wide Customer Base

Currently, about 70% of the India’s software revenues come from USA. It is recommended that firms build a sizeable base in Europe and APAC too as it will help firms minimize the correlation between the firm’s growth and the economic conditions in US. In addition, there should not be too much dependency on a particular client or a particular vertical. This way, the business cycles in a particular vertical will least impact the firm’s growth.

3.7 Expand Portfolio of Services

Most Indian IT firms today operate at the middle or lower end of the value chain. There must be an effort to move up the value chain to garner higher margin business and to also tap on to its trickle effect.

3.8 Acquire Domain Knowledge

It is recommended that firms should hire resources that are experienced not only in various technologies but also in certain verticals. The firms should also ensure that adequate training and exposure is provided to the employees to acquire domain expertise.

4. Indian IT Firms – Strengths and Limitations in Global Expansion

4.1 Strengths

4.1.1 Processes

Most Indian firms have standard processes (say, Capability Maturity model) ingrained in the organization right from hiring, training to delivery and maintenance. These processes ensure that the quality is maintained while businesses scale up.

4.1.2 Management

Indian management has been excellent in project and process management. The Major software players have an excellent record in delivering services within time and within budget.

4.1.3 Early movers into Low cost GDM

Indians have been the pioneers of the low cost GDM. The global giants, having recently entered this space would take another 2-3 years to fully understand and deliver low cost services (and understand the cultural issues). This should provide enough lead time to Indian firms to build scale abroad.

4.2 Limitations

4.2.1 Limited Financial Strength

The IBMs and Accentures can easily carry out big acquisitions and expand their global presence much faster than their Indian counterparts.

4.2.2 Knowledge Leadership

In association with IT services, knowledge leadership spans three somewhat overlapping categories: technology innovations, concept development, and process leadership. Indian IT firms have established a high standard in software development, but not in innovating next-generation tools, languages, technology concepts, and standards.

Although they will encounter both internal challenges and external constraints during the process, Indian firms must acquire these knowledge leadership capabilities if they are to compete successfully for large and mega projects.

5. Challenges for Managing a Global Organization

5.1 Primary Research Results

We asked a set of IT managers on what they felt were the biggest challenges in managing a global organization. The results are shown below:

5.2 Preventing Over-Diversification

As an organization expands to other locations, there will come a point where the benefits of diversification may begin to diminish. The complexity of trying to manage too many different locations may otherwise start to cancel out any risk mitigation benefits for ensuring a more predictable return.

5.3 Achieving seamless integration

As an organization achieves a diversified portfolio of workforce sourcing options, its management will be challenged with uniting the independent workforce locations as a single, cohesive unit. This requires providing a commonality of infrastructure, process, vocabulary and culture.

5.4 Common operating model

To help achieve seamless integration, individual work streams and lifecycles must be managed end-to-end by a global network governed with a single operating model. Aligning by skills rather than applications enables improved workload balancing of employees as well as increased reuse of technology assets and application patterns.

5.5 Business requirements management

Firms should focus on achieving business objectives and results versus just contractual compliance. To help achieve objectives, tight linkage to the business requirements is essential. Otherwise, small ripples of misunderstandings can easily become tidal waves by the time they reach global sites. The introduction of multiple remote sites will only amplify such misunderstandings, translating into missed business objectives

5.6 Governance

Governance is the critical component (formal and informal processes and rules for managing the relationships between organizational entities) for ensuring an organization’s operating methods are consistently applied across a multi-site delivery network.

5.7 Managing Diverse Cultures

Moving beyond geographical boundaries to build a global delivery model will see organizations building their people assets from a multiplicity of backgrounds, cultures, regions and religions. Also prevalent will be teams composed of employees from different regions of the world. A focused efforts towards maintaining the work ethos and acceptance of diverse perspectives can effectively lay the foundation for employees to feel comfortable in any and every work setting where they would treat fellow colleagues with due respect and appreciation.

5.8 Managing Cost Structures

As Indian firms expand abroad (both in developed and developing nations) and global firms in India, their cost structures will converge. Given this inevitable outcome, Indian firms must rapidly build scale to prevent being wiped out.

5.9 Managing Growth

Indian firms need to seek culture-specific talents such as familiarity with work culture, laws, social norms, and government bureaucracy. Most Indian IT firms will continue to face significant challenges in retaining talent in an expanding market with increased competition from global competitors.

The focus in this regard should always be on building a strong foundation of people and systems early on which can provide the support for not only managing but also sustaining a fast pace of growth. Even during growth phases, the business objectives, which are to serve customers efficiently and effectively should not be put aside in the hope of delivering them greater value post the formation of an even larger organization.

5.10 Innovation

Management must alter incentives and organizational processes to foster innovative thinking. Indian firms must challenge established practices and support their workers in pursuing unconventional thinking.

6. Tapping Foreign Capital

The route that Indian software giants have followed is first building on the financial strength of their local investors and seeking employees’ contribution for growth & expansion. These companies have then moved towards listing their shares on NASDAQ and other exchanges in the form of ADRs / GDRs. To be able to find a strong foothold in foreign markets, or even among foreign investors in India, it is very essential to reach a certain scale of operations.

Firms like Infosys and TCS, because of their partnerships with many of the Fortune 500 companies, held them in good stead in terms of reputation and professionalism. And it was the confidence of these Fortune 500 firms that led to investor confidence from outside India in these firms. Recently, The Government of India has also started actively providing fiscal incentives and liberalizing norms for FDI and raising capital abroad.

Private Equity is another source of funding for expansion. Until 1999, the venture creation phenomenon for the IT sector in India had been quite unsatisfactory. However, post 2000, things have been changing dramatically for the better. Venture capital has been the main source of finance for software industry in India, and even around the world, in the small and medium enterprise sector. Companies that have benefited the most from VC funding are Rediff, Mastek and many others. Post the dot com bust, norms for the operations of venture capital funds have also been liberalized to boost the industry.

7. Conclusion

MNC companies will have to learn the ropes, make investments and make the required changes in sales, delivery and marketing in order to deliver lower cost services. For this, they will need at least 2 to 3 years. This time must be utilized by Indian firms to establish their low cost centers abroad as well as their presence near the clients.

In conclusion, the Indian software industry is undergoing a decisive phase in its evolution today, and it would be a wise step for the industry to take lessons from the Big Five. The challenges and strategies presented in the paper are generic and individual firms will need to perform a deeper analysis into how they can win this game at the global level – where it is bound to reach in the very near future.