October - December 2006 Vol 2 Issue 11

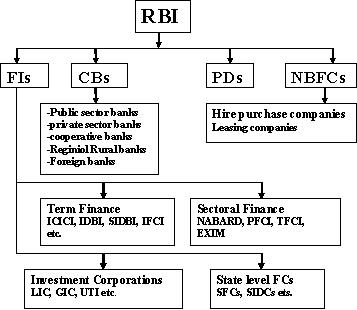

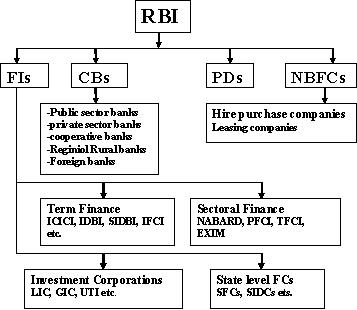

With liberalization of financial sector, banks have been given complete autonomy for fixing the rates of interest on their deposite & loans. However, policy directions are still given by the government and the central bank of the country by adjusting other benchmark rates or through public statements/private briefing. The freedom of investment continous to be regulated and directed lending still account for nearly half of the total loan portfolio of the commercial banks.

Priority sector loans are to account for atleast 40% of aggregate loan of a bank. Moreover export credit should account for atleast 12% of the total outstanding.

In order to ensure suffient liquidity for banking system, the central bank has stipulated the following

• Each commercial bank has to maintain a compulsory Cash Reserve Ratio (CRR) with Reserve Bank of India (RBI). The current requirement for CRR is 5.5 % of the Net Demand and Time Liability (NDTL) of the bank.

• Each commercial bank has to maintain a Statuary Liquidity Ratio (SLR) by the way of investment in stipulated government securities, amounting to atleast 25% of it NDTL.

Besides, following the famous Basel 2 accord, RBI has also stipulated that each commercial bank has to comply with the Capital Adequacy Requirement (CAR) where by it must have capital of atleast a certain percentage of its risk weighted assets and off balance sheet exposures. At present CAR is 9% & which is expected to rise up to 10%.

by Shyam Ji Mittal, MBA IT 1st Sem, IIITA.

X'Pressions

Banking in India

With liberalization of financial sector, banks have been given complete autonomy for fixing the rates of interest on their deposite & loans. However, policy directions are still given by the government and the central bank of the country by adjusting other benchmark rates or through public statements/private briefing. The freedom of investment continous to be regulated and directed lending still account for nearly half of the total loan portfolio of the commercial banks.

Priority sector loans are to account for atleast 40% of aggregate loan of a bank. Moreover export credit should account for atleast 12% of the total outstanding.

In order to ensure suffient liquidity for banking system, the central bank has stipulated the following

• Each commercial bank has to maintain a compulsory Cash Reserve Ratio (CRR) with Reserve Bank of India (RBI). The current requirement for CRR is 5.5 % of the Net Demand and Time Liability (NDTL) of the bank.

• Each commercial bank has to maintain a Statuary Liquidity Ratio (SLR) by the way of investment in stipulated government securities, amounting to atleast 25% of it NDTL.

Besides, following the famous Basel 2 accord, RBI has also stipulated that each commercial bank has to comply with the Capital Adequacy Requirement (CAR) where by it must have capital of atleast a certain percentage of its risk weighted assets and off balance sheet exposures. At present CAR is 9% & which is expected to rise up to 10%.

by Shyam Ji Mittal, MBA IT 1st Sem, IIITA.