|

| Family |

|

| Main Page |

|

| Cascading |

|

| Voltface |

|

| CampusBuzz |

|

| Limelight |

|

| URL |

|

| Brainwave |

|

| Insight |

|

| Technova |

|

| Perspective |

|

| X'Pressions |

|

|

|

|

|

|

|

|

|

| IIITA's e-Magazine |

|

Oct-Dec 2007 Vol 4 Issue 15 Oct-Dec 2007 Vol 4 Issue 15 |

|

|

|

|

Perspective |

|

|

|

| Great Indian Leverage Buy

|

This is what I mean when someone talks about Leverage Buy Out………..

Leverage Buy Out or Bootstrap is term to describe an acquisition (of a large company by a small company) by leveraging the assets and cash flows of the target, i.e. in acquisitions, usually, the company that is being acquired is used to raise the funds and to ensure no financial liability flows back to sponsor.

In early 1960’s LBO gained momentum as companies were trying to build conglomerates, which required raising resources far greater than what companies were generating. In 1988, the PE (Private Equity) firm KKR (Kohlberg Kravis Roberts & Co) were at the heart of that LBO boom. There buy out of RJR Nabisco in 1988 for $31.5 billion was the famous fall out because RJR Nabisco’s cash flows were insufficient to pay off the huge debt resulting in Senior Bank Debt of $15 billion and a Subordinate Debt of $5 billion.

Recent Indian LBOs :

India Inc’s hunger for global giants to raise their scale and compete on global scale together with innovative financing options and under-levered Balance Sheet are encouraging Indian companies to acquire assets globally for access to new markets.

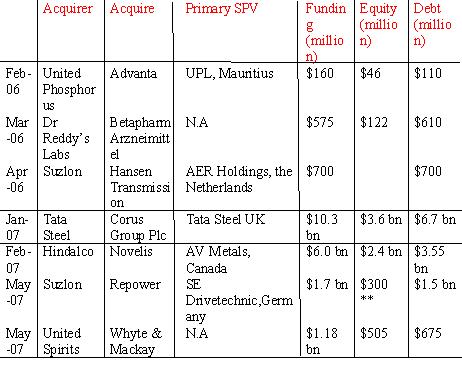

For years, debt was a dirty word in corporate India, now in order to achieve higher growth; there is an increasing trend to use LBOs to fund large acquisition and infrastructure investments by Indian companies. The following table illustrates the recent LBOs by Indian companies.

|

|

** Rest of funding is still to be arranged

The following table indicates that many LBOs involve commodity players and all these deals are done when the commodities prices like steel, aluminium are at peak. And, the liquidity in the market has enabled the western banks to make the loans to Indian companies.

Now let us discuss few of these deals briefly:

Tata-Corus: Tata Steel’s buy out of Corus for $10.3 billion which is more than twice its networth has truned it into the world’s fifth largest steel producer, however the deal includes Debt component of $6.7 billion which has to be paid in nine years, paying an interest rate of 50 basis points over LIBOR (Landon Inter Bank Exchange Rate) and with Tata Steel’s finances already stretched out by a massive $6.75 billion domestic expansion. To raise the funds a special purpose vehicle Tata Steel UK was created. Tata Steel has to pay back $800 million per year for next nine years to clear its debt, whereas looking at the surplus cash (profit) generated by Corus every year which is approximately $458 million, this creates a shortage of $342 million and also Tata Steel requires extra cash for managing its operations. Now the management has to be right on their toes to fulfill the expectation of the shareholders and deliver the operation synergies they are promising to the investors and also cope with a declining steel cycle, which is already off- peak due to softening of demand in China.

Hindalco-Novelis: India’s largest aluminium producer, Hindalco Industries, with revenues of $4.75 billion and manufacturing capacity of 461,000 tonnes, acquired Novelis of Canada for $6 billion when the prices of aluminium is at peak and rates are expected to slide from here. And, to pay all the debt, Novelis has to fire on all cylinders if the Aditya Birla group has to pay back $2.5 billion debt on Novelis balance sheet and another $3.5 billion on Hindalco’s. However, Novelis, which is incurred a net loss $275 million in 2006, not only needs to turnaround but also has to make a net profit of at leat $1 billion every year to pay off its debt in a reasonable time of 7-9 years.

Similarly, talking about other acquisitions like Whyte & Mackay by United Spirits for $1.8 billion, $675 million of which has been raised through loans. And Dr.Reddy’s buyout of German generic maker betapharma for $570 million, $475 of which came as loans.

LBO, it is said, don’t fail, they just get re-financed, but some find themselves in such a vicious cycle of re-financing that they struggle to come out of it. Tata Tea’s acquisition of UK”S Tetlley Tea (India’s first major global LBO) was one such case. Luckily, the company was saved when it made a windfall profit of $523 million by buying and then selling a 30 percent stake in US-based Energy brands, better known as Glaceau. The cash thus generated will be used to pay off the $600 million debt Tata Tea took on to buy Tetley.

Now, the question arises before us is that whether Indian companies have the capabilities to synergies the operations of these newly acquired companies, not only to pay debts in stipulated time, creating a globally competitive organization and hence thereby creating value for shareholders

|

|

|

|

|