INSIGHT

Micro credit - A Tool for Development

by Anubha Sharan

MBA – R.D., Govind Ballabh Pant Social Science Institute,

Allahabad

Micro credit has become a major tool of development, and it’s fast developing as an international industry, with its own trade association, dedicated finance, training and other support organization, research and journal.

With millions of poor people in developing countries still unbalanced, there is clearly a need for the provision of micro financial intermediation at a mass scale, and this can be archived through substainability.In this sense, the combination of outreach and sustainability is developmental. Hundreds of millions of people lack access to the formal financial sector. As a result, they cannot save, borrow, buy homes, or grow their businesses—a significant social and economic cost to the communities and countries in which they live. Sub-Saharan Africa and South Asia (home to more than 85% of the Commonwealth) have within them the largest concentrations of hungry people in the world. [UNDP (2003) UNDP Human Development Report 2003, Oxford University Press, New Delhi, p. 6.].

Micro financial services can not only solve their own poverty, but can also serve as a complementary tool within a broader strategy to reduce poverty.

The organizational challenges of combining often broadly conceived developmental goals with the technical delivery of micro financial service are a key theme of the analysis.

Organizational sustainability including sustaining a focus on development mission is as challenging as achieving financial sustainability. One of the major reasons for the lack of dynamic enterprise in developing countries is the shortage of affordable credit and investment to support new enterprises. This is often the result of adverse macroeconomic policies (including those aimed at bringing in foreign capital flows or preventing their outflow) and a lack of appropriate financing channels and mechanisms suited to developing market conditions. The development of the two key financial sectors—banking (including micro-finance) and venture capital—is crucial 1

Taking the example of Africa, Pride Africa is the largest micro-finance institution in East Africa and is addressing this challenge in an innovative way. The organization has lending operations in five countries, a client base of 100,000, and reaches some of the poorest of the poor. The loans finance everything from trading operations to production of foodstuffs to manufacturing of clothing. It is designed as a franchise model built around proprietary software systems, uniform processes, and extensive training to achieve pan-regional economies of scale that allow for rapid, cost-effective expansion. The software provides loan tracking, financial projections, and branch office management information. Its use has significantly streamlined the organization's internal transactions, both reducing costs and demonstrating an approach to improving the fundamental inefficiencies of the micro-finance industry. Pride Africa serves as a buffer between large commercial banks and thousands of small clients, and offers a range of financial services currently not available to micro-enterprises, particularly in poor communities. The software that will make this intermediary role possible is presently being piloted in Kenya.

In Bangladesh, 97 percent of homes and virtually all rural villages lack a telephone, making the country one of the least wired in the world. This lack of connectivity has contributed to the underdevelopment of the country and the impoverishment of individual Bangladeshis. To address this problem, Grameen Bank, a micro-finance institution, formed two entities: 1) Grameen Telecommunications, a wholly-owned non-profit organization to provide phone services in rural areas as an income-generating activity for members of Grameen Bank, and 2) Grameen Phone Ltd., a for-profit entity that in 1996 bid on and won a national GSM cellular license. Grameen Phone has since become the country's dominant mobile carrier.

India is also fast becoming one of the largest micro- finance markets in the world, especially with the growth of women’s savings and credit groups which are set to reach 17 million women by 2008 at latest and which we explore in depth.

The impact on rural credit supply was also significant as the proportion of rural credit from 29.2% in 1971 to 61.2% 1981, although this fell back to 56.6% by 1991.

Share Microfin limited 2 is one of the largest microfinance institutions in India, serving more than 1 million poor households.

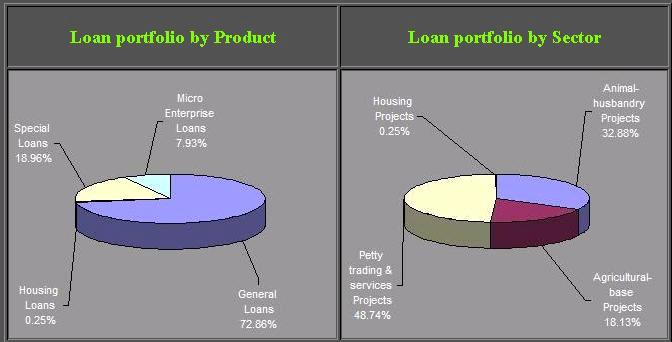

Fig 3

It has a very good loan portfolio for the rural sector.

In reality, poor people need access to many more financial services than just micro-credit, including a range of micro savings and insurance products.

Appropriate savings and insurance as well as loans for emerging expenditure or for basic assets such as housing & education can contribute significantly to such securities and help the poorer and more vulnerable households.

These services can protect poor people from the impact of unforeseen crisis and emergencies in their household or micro-business, from falling yet further into debt, and enable poor households to plan and manage their limited resources more effectively to meet their basic needs.

Sources:

* 1 http://www.opt-init.org/framework/onepage/onepage.html

* 2 http://www.mixmarket.org/en/demand/demand.show.profile.asp?ett=51#

* Fig 3 http://www.sharemicrofin.com/products.html

* Beyond Micro credit: putting development back into micro finance By: Fisher T & Sriram

Disclaimer : The views

expressed in the articles are author’s own views B’Cognizance or

IIITA is not liable for any objections arising out of the same.

The matter here is solely for academic use only.