B-Cognizance

B-CognizanceIndian Institute of Information Technology, Allahabad.

E- Magazine August - September 2006 Vol 2 Issue 10

BRAINWAVE

Indian Software Industry: the way forward

(Indian Software Industry: moving up the value chain? )

Rahul Budhwar

Faculty of Management Studies

For a long time, Indian software industry has been based on the labor cost arbitrage model. That is, if a software developer is paid X dollars per month in a developed country, an Indian software engineer would be paid a fraction for the same job. This model has served Indian software companies well and hence they have thrived over the last decade. However, like any business model, this model is not sustainable forever. Low cost service providing countries like China, Russia, Philippines, South Africa and others are quickly catching up on the Indian model. With increase in employee compensation, strengthening of the rupee, increasing competition and a host of other factors, India will not remain a cheap destination for software services as compared to these new entrants. Hence to continue thriving, the Indian software industry has to provide more value to their global clients by moving up the IT value chain. If they are providing software maintenance or infrastructure management services, they will need to look at providing high-end business and technology consulting and if they are offering product maintenance services, they must invest in research and development and come up with innovative products.

This paper will explain the IT Value chain, why the Indian IT vendors must move up within it, the advantages they currently have, what they need to watch out for and some recommendations on moving up the value chain.

The IT Value Chain

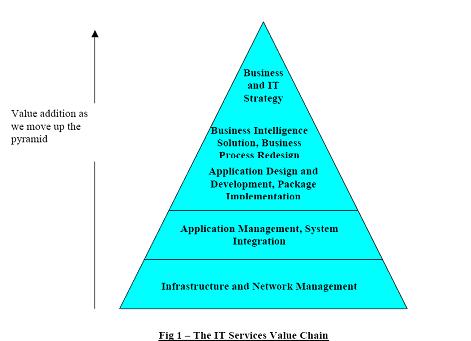

The IT value chain refers to the IT components, processes and services that collectively deliver value to the firm's business components and services and, potentially, to the firm's external customers.

Broadly, consulting and IT strategy form the top end of the value chain, followed by application design and development, application management, package implementation and finally, network and telecom infrastructure management, that constitute the bottom of the value chain.

Why move up the value chain?

Why should Indian IT firms move up the value chain when they have been seeing impressive growth over a long period of time (The Indian IT industry is growing at over 30 % every year)? The reasons are evident:

1. Rising Employee Costs – Employee compensation (which accounts for nearly 50% of employee costs for an IT firm) has been increasing over the last few years (neoIT's offshore and near-shore salary report for 2004 shows that IT salaries in India experienced the maximum growth - 13 per cent) and attrition rates are at an all time high (around 15% on an average for large firms). This problem gets compounded when a company invests significant resources in training the employee and (s)he leaves for better opportunities elsewhere.

2. Strengthening of Rupee – The rupee has strengthened over the last few years and is currently hovering at INR 43 to a US dollar. Since approximately 70% of India’s software business comes from the USA, margins decrease with the strengthening of the rupee. It is said that every 1 per cent appreciation in the rupee can reduce Profit Before Tax (PBT) by 2 per cent to 4 per cent.

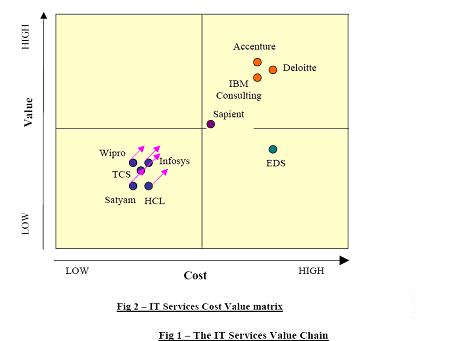

3. Foreign companies entering India - Foreign IT consulting firms (like Accenture, IBM) are setting up operations in India and thus the Indian vendors are losing their cost advantage.

4. Other low cost countries developing skills – China, Philippines, Russia and Eastern European countries are aggressively developing their language and technical skills and looking to copy the low cost Indian model. In fact, these countries would offer services at even lower costs and the Indian vendors will again lose their cost advantage.

5. Downstream Revenue generation – Work done at the top of the IT value chain (say IT strategy consulting) helps generate downstream revenue (the strategy work leading to application design and development and finally management). A senior executive at a leading multinational IT services firm says that for every $1 that he generates from consulting, he expects at least $10 of downstream revenue.

6. Higher margins at the top – The work at the top of the value chain is of high cost - high value. Accordingly, there are higher margins to reap in such work that will help ease pressure on margins that exist today.

Advantages for Indian Firms

1. Political Stability – India is the largest democracy in the world and is stable politically with 2 national parties (which have similar positive outlook towards the IT industry) and a number of smaller regional parties.

2. Favorable policies by the government – The Indian government has been supportive of the IT industry. It has allowed tax exemptions (like tax incentives for centers in Software Technology Parks or Export Processing Zones) and benefits like 100% FDI. Some of the state governments (Andhra Pradesh, Karnataka, Tamil Nadu and others) too aggressively promote IT investments within their states.

3. Existing Clients and Relationships – Indian IT companies have healthy relationships with their existing global clients. This gives them a head-start as compared to organizations from other countries.

4. Large talent pool – There is a large talent pool of young, educated people in India. Our technical education system is one of the strongest in the world. The number of engineers our country is producing is increasing every year and this would serve the software industry well since they are facing manpower shortage. Even at current rates, there will approximately be 17 million people available to the IT industry by 2008 (Source: NASSCOM.org).

5. Favorable Macroeconomic Factors – India has the potential to show the fastest growth over the next 30 and 50 years. Growth could be higher than 5% over the next 30 years and close to 5% as late as 2050. Among India, China, Russia and Brazil, India will be the only country recording growth rates significantly above 3%. In addition, inflation has been stable in India and in USA and is likely to be remain so the next few years.

6. Telecom Infrastructure – Telecom structure has rapidly improved over the last few years. Liberalization of this sector has allowed private players to enter multiple segments (ILD, NLD), which has increased competition, improved quality and reduced costs. These improvements have benefited the software industry which is increasingly getting based on the global delivery model. In fact, the reduced communication costs can offset cost increases in other areas of this industry.

7. NASSCOM – the National Association of Software and Services Companies is a strong industry lobbying body in India and also carries clout in USA. It constantly and effectively works towards the benefit of the IT industry.

8. Fragmented Market – The technology consulting market is extremely fragmented with 78.4 % of the industry market shared across many players (Source: DataMonitor). This is a great opportunity for Indian players to grab a large chunk of the market.

What to watch out for?

1. Fluctuating Exchange Rates – Indian software firms need to be wary of the fluctuating exchange rates. One way to reduce risk is to do billing in a basket of currencies rather than just the US dollar.

2. Consulting is a small fraction of the IT Pie – The percentage share of Consulting in the IT services Pie is about 10.3 % (Source: Datamontitor) with a number of players competing for it. Any Indian software firm entering this space must expect a lot of retaliation from established players.

3. Low industry growth rate – The IT consulting industry growth rate stands at 3.7% in 2003 as compared to 14% in 2000 (Source: Datamonitor) while number of players has also been increasing. Though the overall growth rate is expected to increase, the Indian software firms should make investments in high growth sectors within the consulting industry.

4. India’s relationship with its neighbors – India’s relations with Pakistan could affect the investments being made. However, off late, both sides have made efforts to promote peace in the region and this has been viewed positively by the industry.

5. Poor Infrastructure – India’s infrastructure development continues to move at a very slow pace. This could be a deterrent to high value work coming to India since clients might not trust India’s capability in delivering mission critical solutions. Wipro’s chief Mr. Azim Premji has been vocal about his disappointment over the extremely slow pace of infrastructure development in Bangalore to the point that he said Wipro would invest in other cities

6. Dependence on US economy – Almost 70% of software business comes from the USA and down-cycles in the US economy will have a tremendous impact on the consulting/product development businesses of Indian firms since those are the first areas where any company cuts budgets during a down cycle.

7. Intellectual Property and Data Security Concerns – Implementation of Intellectual property rights and data security are topmost concerns for foreign businesses investing in India and software firms should take adequate steps to ensure the same.

8. Not entering Management Consulting space – Software firms should avoid getting into pure management consulting services since that is not their core competence and because there are a number of well-established players in that industry. Instead, they could look at partnering with such firms to provide end-to-end solutions.

9. Moving up is tougher than moving down – Being at the top end of the chain requires credibility and not cheap skilled labor and hence companies will find it tougher to establish a presence there.

Instances of companies moving up the value chain

A number of Indian companies are looking ahead and choosing to move up the IT value chain. Some of these companies are listed below:

1. Infosys – Infosys Technologies started Infosys consulting in 2004 in USA with an investment of US $ 20 million to focus on delivering high value business/technology consulting.

2. Wipro – Wipro bought out the American Management Systems’ energy practice for US $ 26 million (November 2002) and NerveWire for US $ 17 million (May 2003), which shows its focus on building high end consulting expertise.

Recommendations for moving up the value chain

Following are our generic recommendations for software companies that wish to move up the IT value chain.

1. Building up domain knowledge – Firms must build up focused domain knowledge for their employees. A number of companies are moving in that direction by dividing their business according to industry or geography and aligning people to those verticals. The organizations should also focus on providing domain specific training to their people.

2. Knowledge Management – A company must build good practices to retain the knowledge within the organization. Knowledge must be codified so that even if an employee leaves, the knowledge stays with the company.

3. Investing in R&D – Companies must invest in R&D to create ‘bleeding edge’ (read ‘innovative’) technology products. This will allow them to compete with global product majors at an even platform. If an Indian firm comes out with products like Oracle’s Database systems or Microsoft’s Windows Operating platform, there is tremendous potential to be tapped at the global level.

4. Scaling up quickly – Expanding fast is another key to be successful in the long run. Although companies can focus on a niche market initially to achieve success (say providing telecom software services or financial products), they need to quickly expand to other services/products. The danger in not doing so is that you may risk being acquired by another firm or being wiped out of the market if your single product/service is superceded by another product/service offering. Another advantage with a large firm is that of stability and market presence. E.g. Companies would typically prefer to deal with SAP or Oracle for their database product needs rather than a small firm, which may have a great product but may not exist 6 months later.

5. Inorganic Growth – Since it is not always possible to build capabilities internally, companies should look at inorganic growth as a means to scale up quickly. The recent acquisition of PWC by IBM is such an example adopted by a major software firm in a bid to move up the value chain.

6. Global Delivery Model – The global delivery model, where work is distributed among teams located offshore and onshore (with a larger proportion of work offshore), is currently the best model for executing projects. However, by offshore locations, only India is not implied. Software firms should look at low cost centers like China, Philippines, Eastern Europe and other regions as potential offshore development locations.

7. Managing Existing Accounts – Maintaining a good relationship with existing clients is important since these relationships can be leveraged to get business higher up in the value chain.

8. Building Brand Recognition – Consulting firms are all about building brand equity with the clients as well as in the market. A reputed firm has a much higher chance of getting business as opposed to a lesser-known firm. Another important aspect for the success of any firm would be to instill a sense of purpose, vision and values within their employees. Many organizations fail because their people are disconnected from the overall objectives and culture of the organization.

Conclusion

To sum up, I can say that if the software industry’s business model will continue to be based on cheap skilled labor, then the threat of the software work shifting to other low cost service providing countries is very real and very immediate. Indian companies should accept the fact that employee costs are going to go up and they should look at doing more valuable work for their clients for higher charges. We claim that we are a software superpower, yet our software industry is barely 3% of global IT spending. Therefore, the road ahead is long and arduous but it needs to taken if our software companies want to be around in the long run.

Content is © Indian Institute of Information Technology - Allahabad

Powered by www.iiita.ac.in